DSBconnect Bill Pay

If you are a personal or business checking account holder, you can initiate payments to payee companies and people through our DSB Bill Pay and our service provider, iPay. You schedule the payment on your DSBconnect login, and iPay generates the payment with funds drawn from your DSB checking account.

What does it cost to use the service?

The service is free and unlimited to all users. Fees for stop-payment orders and overdraft/NSFs apply. You can choose for expedited delivery, and the fees charged by iPay are disclosed if chosen.

How does Bill Pay work?

Once you are fully registered to use Bill Pay (see instructions below), login to DSBconnect and click Transfer Money in main menu. You first set up a profile for the payee by clicking "New Transaction" and follow the prompts. You only have to establish a payee profile one time - not each time you pay a bill to that payee. Be sure to key in the full account number you have with the payee, including full account numbers on bank accounts and credit cards. Once the profile is set up, you can schedule a payment to that payee whenever you want. You continue to receive your invoices and statements from payees just as you always have (unless or in addition to the eBill option if presented to you from qualifying payees). Instead of writing a check to the payee and delivering it in person or mailing it, you schedule your payment through the Bill Pay service. When you are ready to schedule a payment, you select the payee from your list, choose the funding account, type in the payment amount, select a payment delivery date, and submit.

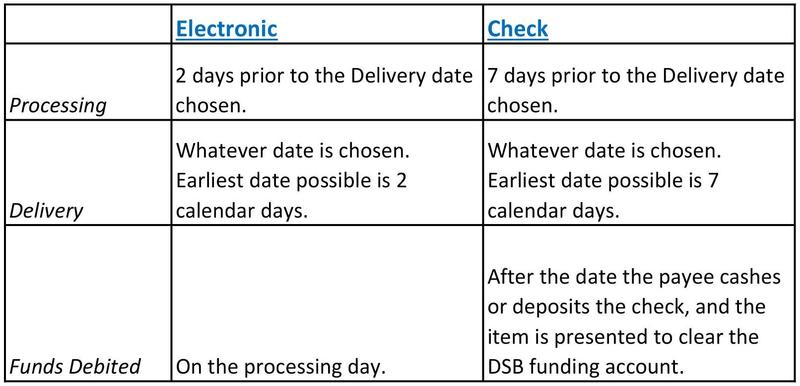

Electronic or Check:

- If the payee can accept electronic payments, the payment will be delivered to the payee electronically 2 business days after the scheduled processing date (ex: you schedule the payment by the deadline on a Monday, and the electronic payee receives it Wednesday morning).

- If the payee cannot accept electronic payments, the payment will be delivered to the payee by mailed check, subject to regular postal delivery time, usually 5-7 business days after the scheduled processing date.

The bank has no control on how any payee accepts payments. Some can accept electronic payments, and some cannot.

On either type of payment, the account number you have with the payee will be recorded on the payment to ensure proper credit is made to your account.

Scheduling:

When scheduling a payment, on the question "When should it occur" that means "When do you want the payment to arrive to the payee?". Be sure to schedule by the delivery date, not the send date. For whatever delivery date you choose, it will show the processing date under it.

- If you schedule the Bill Pay to be processed as early as possible, on same business day, it will be generated that business day and arrive to the payee either 2 business days later if electronic or in 5-7 days if by check.

- If you schedule the Bill Pay to be processed on a future delivery date, it will arrive on the delivery date you key in. It will be generated 2 days prior if electronic or 5-7 days prior if check.

When you schedule a payment, it will show in the "Scheduled" section of Move Money until it processes, and then it moves to the "Previous" section.

Debiting of Funds:

The funds to make a payment will be automatically debited from your chosen DSB checking account.

- If the payment is sent electronically, the funds will debit out the on processing day of the payment. (ex: you schedule the payment to be processed on a Monday, the funds debit out on Monday). The debit description will be in the Electronic Activity portion of your statement.

- If the payment is a mailed check, the funds debit out whenever the payee cashes or deposits that check. If the check is cashed or deposited, it creates a clearing item on your checking account and you will have an image of that cleared check.

How can I ensure the payee received proper payment?

Find your item payment status in the "Previous" section once the payment is processed. If the payee reports to you that payment was not received by the end of the Delivery date you chose, notify DSB and we will assist to resolve the issue.

Does Bill Pay save me time and money?

Not only is this service free and unlimited, but consider the costs of traditional check writing:

Checks: Most consumers have to buy their own paper checks, usually costing at least a nickel each. With Bill Pay, the Bill Pay service provider issues the payment on your behalf, either by electronically or by their own paper check. That means you won't be issuing your own checks.

Postage: With Bill Pay, the Bill Pay service provider issues the payment, not you. You do not have to buy first-class postage stamps as you did with mailing them yourself.

Time: Think how much time you spend writing routine checks, stuffing and sealing envelopes, buying stamps, and mailing them out? With Bill Pay, you no longer have to do any of that.

What do I need to use Bill Pay?

First, you must be a registered user of DSBconnect. Then, you need to register for Bill Pay by clicking Transfer Money in main menu, and then Bill Pay New Enrollment. You can immediately begin using the service once you have registered.

Other requirements for Bill Pay:

- You must be a direct owner or authorized payor on the DSB checking account being used.

- You must access the Bill Pay service from a browser login to www.dsbks.com or DSB mobile banking app login.

- Submitted Bill Pay service registrations are automatically approved but are subject to bank review. Past transactional histories will be considered, including overdraft histories. The bank reserves the right to refuse this service to any customer based on past transaction history.

When can I use Bill Pay?

Bill Pay can be accessed any time of day. Bill Pays are processed at 9:00 p.m. CST, Monday-Friday and Sunday (not on Saturday and federal holidays).

Who can I pay and how often and how much?

You can pay any payee in the United States. It is recommended that you not pay taxes using Bill Pay. You can schedule a one-time single payment, or you can schedule recurring payments of the same amount to the same payee on a certain frequency. Each per-item Bill Pay to a company can be up to $20,000 max. There is a daily limit of $20,000 for all total Bill Pays.

Can I stop a scheduled or sent payment?

Yes, but only on paper check payments; if payment was sent electronically, you have to contact the payee to work out a refund or credit to your account there. To place a stop payment on a Bill Pay check that has not cleared your account yet, you can contact the bank during business hours, or you can chat live with an authorized iPay agent within the Bill Pay function during business hours.

FDIC-Insured - Backed by the full faith and credit of the U.S. Government

FDIC-Insured - Backed by the full faith and credit of the U.S. Government